Tell me, what is it you plan to do with your one wild, and precious life? – Mary Oliver, American Poet

How I love this quote! It captures why I love the art of planning my spending. Because the art of planning your spending is really the art of planning your life. And I suspect you want a wonderful life full of less stress, more peace, and more fun.

Learning how to plan your spending literally gives you the ability to create a life full of magic. Really!

As we all know, nothing happens without a plan. Or things happen, but haphazardly. Maybe you get what you wanted, and maybe you don’t. I am personally not willing to leave my one wild and precious life to chance. Granted, there are enough curve balls (A pandemic!?) but planning my spending means I can literally create a life that gives me what I desire.

And yet so often people are resistant to planning their spending. Even though we all know that it’s difficult to take a wonderful trip without planning. And I consider my entire life a wonderful trip that is worthy of some planning. I want to dance, I want to travel, I want some lovely clothing, I want a nice retirement account. I want time to enjoy it all. This all takes planning.

I was talking to my good friend about why she broke up with her boyfriend recently. And of course, as women do, it was a long juicy conversation over a bottle of wine. But one of the frustrations she brought up was his inability to plan. There were so many fun things she wanted to do. And yet he literally seemed allergic to planning. This meant they either wandered around aimlessly in their free time together, or she planned something fun for them to do.

None of this bode well for their future.

She knows that with planning, all things are possible, from going to Paris to creating a life with someone full of joy and love.

Planning and Creativity

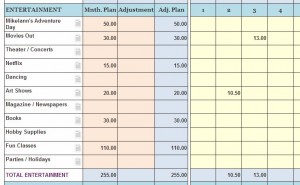

Planning. It is as simple a question as “What do I need and want this month?” Then creativity comes into play as we balance this with our incomes and larger goals. The truth is that creativity responds to articulated needs. When we list out what we need, our creative brain takes on the job of figuring out how to make it happen.

Planning is FULL of creativity. Sometimes, if my resources are going towards a larger financial goal (from paying off debt to building up savings) there may not be a lot of discretionary money left over. Then I ask myself, “how do I creatively get my needs met this month on less money?” My current needs don’t disappear just because I am also focused on larger financial goals. Too often we do not bring creativity into our money lives. We assume that either things work, or they don’t. And if we suspect things “don’t work” then we don’t want to plan. What is the point, we ask?

But planning your spending means you sit down and find a way to make it work. You find a way to get your needs met. You find a way to have what you truly want.

If my need is to spend time with my friends, I may need to find creative ways to see them for less money. Maybe it is over drinks, instead of dinner. Maybe they come to my house for dinner. Planning my spending helped me figure this out.

If I want to go back to school and need more time, maybe I rent out my spare room so I can work less. Planning helps me creatively think through financial possibilities.

All things are possible with planning. It is true that Rome was not built in a day. But a little planning goes a long way.

With enough planning, I was able to find the time to take art classes, as well as the money to pay for an art program. Planning enables me to travel for tango. With planning I was even able to build a second home that I rent out.

Planning your spending IS magic.

It is a blueprint that you can follow to create a life you have dared not dream about.

The art of planning your spending IS the art of planning your life.

The idea of change can be overwhelming, especially when it comes to money. We love the idea of goals, but at the same time, feel overwhelmed by them. We may love the idea of having more money and less debt, but then are immediately distressed by the thought of how to get there. The key lies in beginning to make some shifts inside ourselves, like planting small seeds, since most of us know that true change comes from within. But how to do this?

The idea of change can be overwhelming, especially when it comes to money. We love the idea of goals, but at the same time, feel overwhelmed by them. We may love the idea of having more money and less debt, but then are immediately distressed by the thought of how to get there. The key lies in beginning to make some shifts inside ourselves, like planting small seeds, since most of us know that true change comes from within. But how to do this?

We’ve all had that “feeling” arise–a hunch or a sudden sense guides us on what to do next or gently stops us from proceeding. We hear the whisper that directs us down a new road and leads us to explore a new topic or to avoid a bad situation.

We’ve all had that “feeling” arise–a hunch or a sudden sense guides us on what to do next or gently stops us from proceeding. We hear the whisper that directs us down a new road and leads us to explore a new topic or to avoid a bad situation.

Last week as I was doing some yoga postures and preparing to meditate, it struck me that yoga has some deep similarities to how I handle my money life. Let me share why I think this.

Last week as I was doing some yoga postures and preparing to meditate, it struck me that yoga has some deep similarities to how I handle my money life. Let me share why I think this.

My favorite definition of consciousness is very simple, yet profound: it is the state of being awake and aware of one’s surroundings.

My favorite definition of consciousness is very simple, yet profound: it is the state of being awake and aware of one’s surroundings.

Can you attract more money?

Can you attract more money?